CyStellar TerraRisk Re

End-to-End Visibility into Insurance Portfolio Risks

Data-driven risk view of by integrating satellite data, weather forecast and hazard models.

Integrated geospatial data for ESG insights and climate change risk assessment.

Hundreds of regional hazard models for cumulative risk assessment.

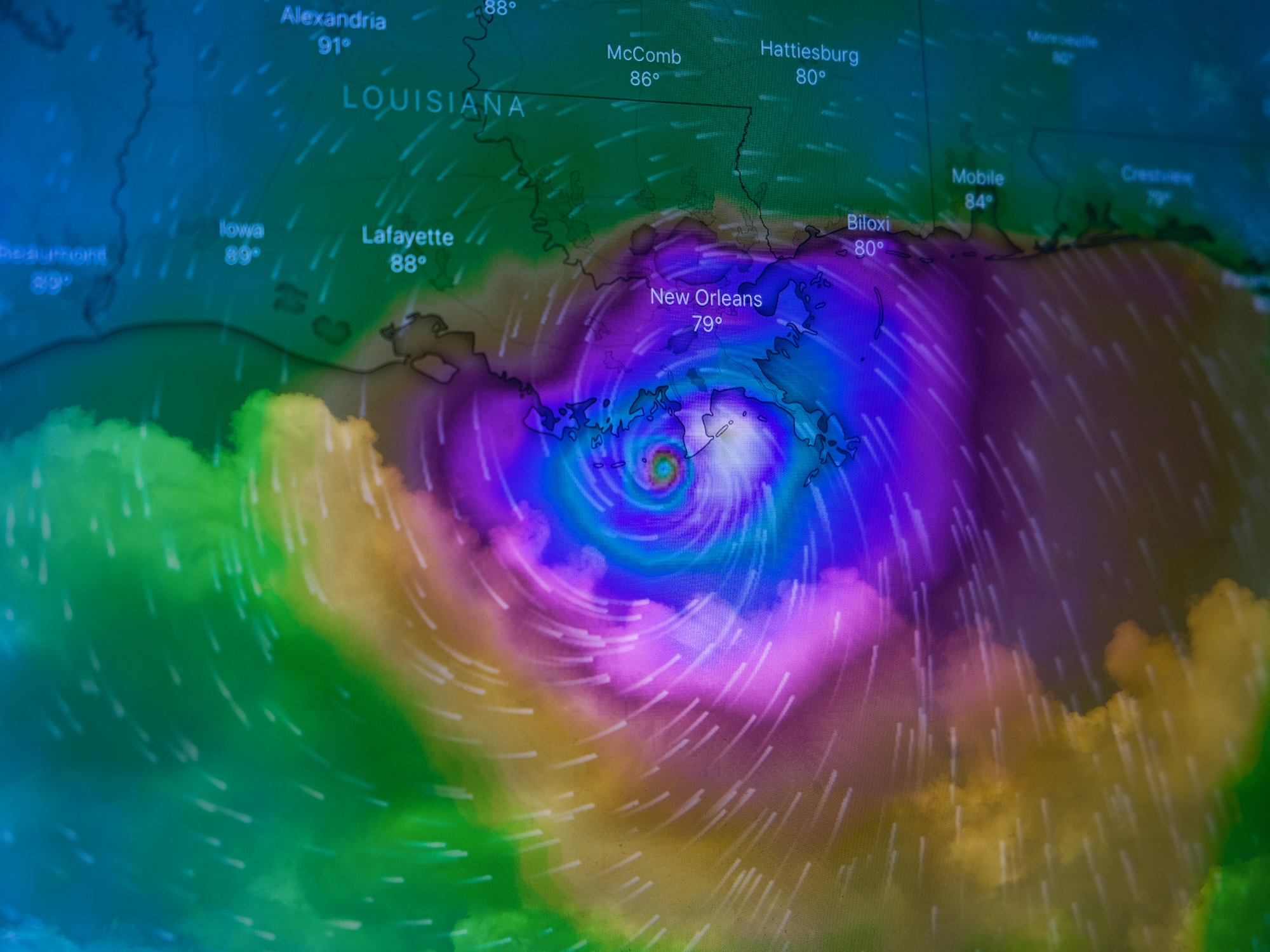

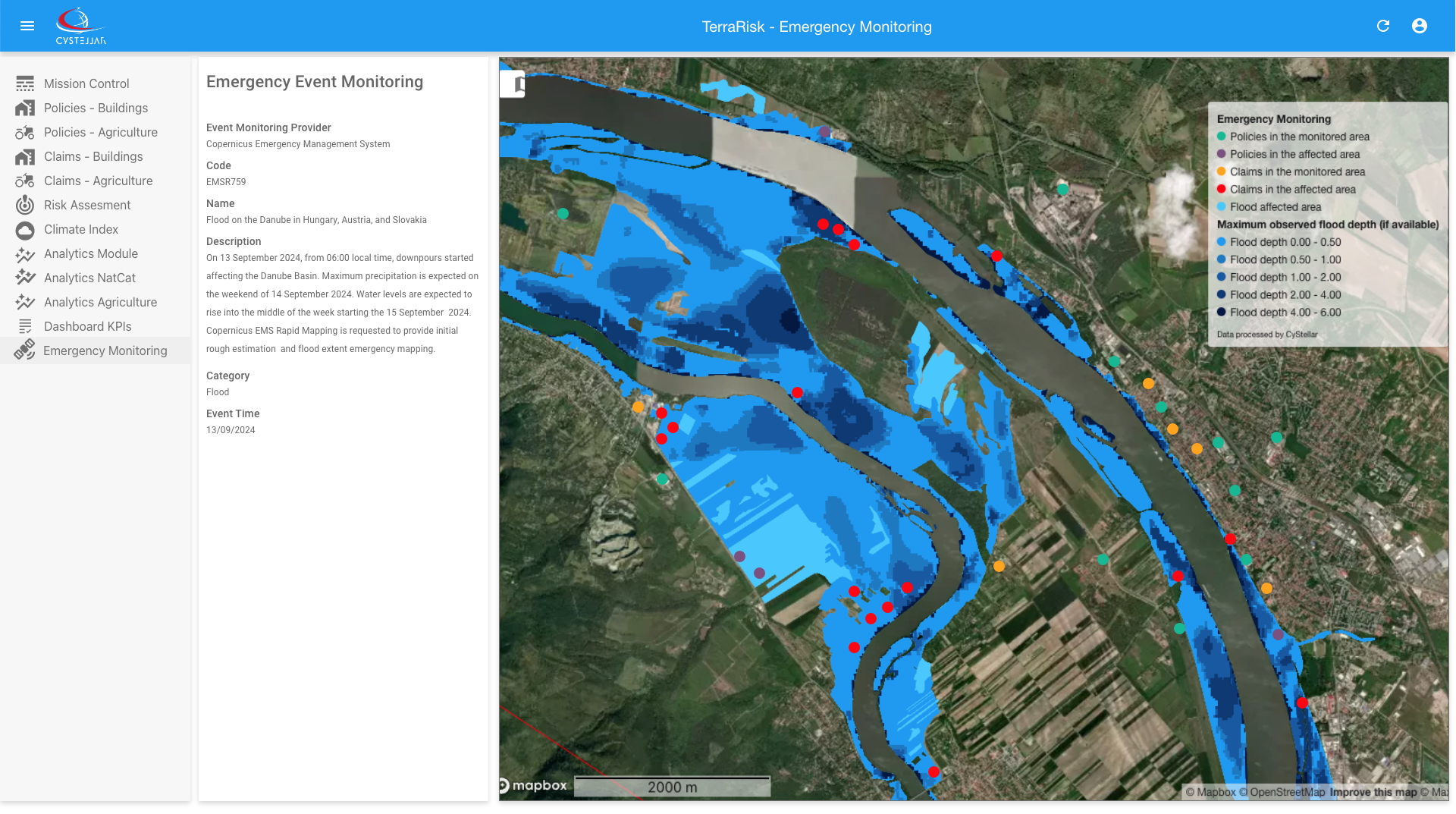

Real-time monitoring of natural catastrophe events.

Comprehensive Risk Insights Across Your Entire Insurance Portfolio

We continuously detect and classify objects, identify topographic and geographic features, and monitor risks with precision, capturing even the slightest changes over time. This information is seamlessly integrated into (re)insurance workflows, providing remarkable insights into nearly any location worldwide and directly connecting to insurance policies.

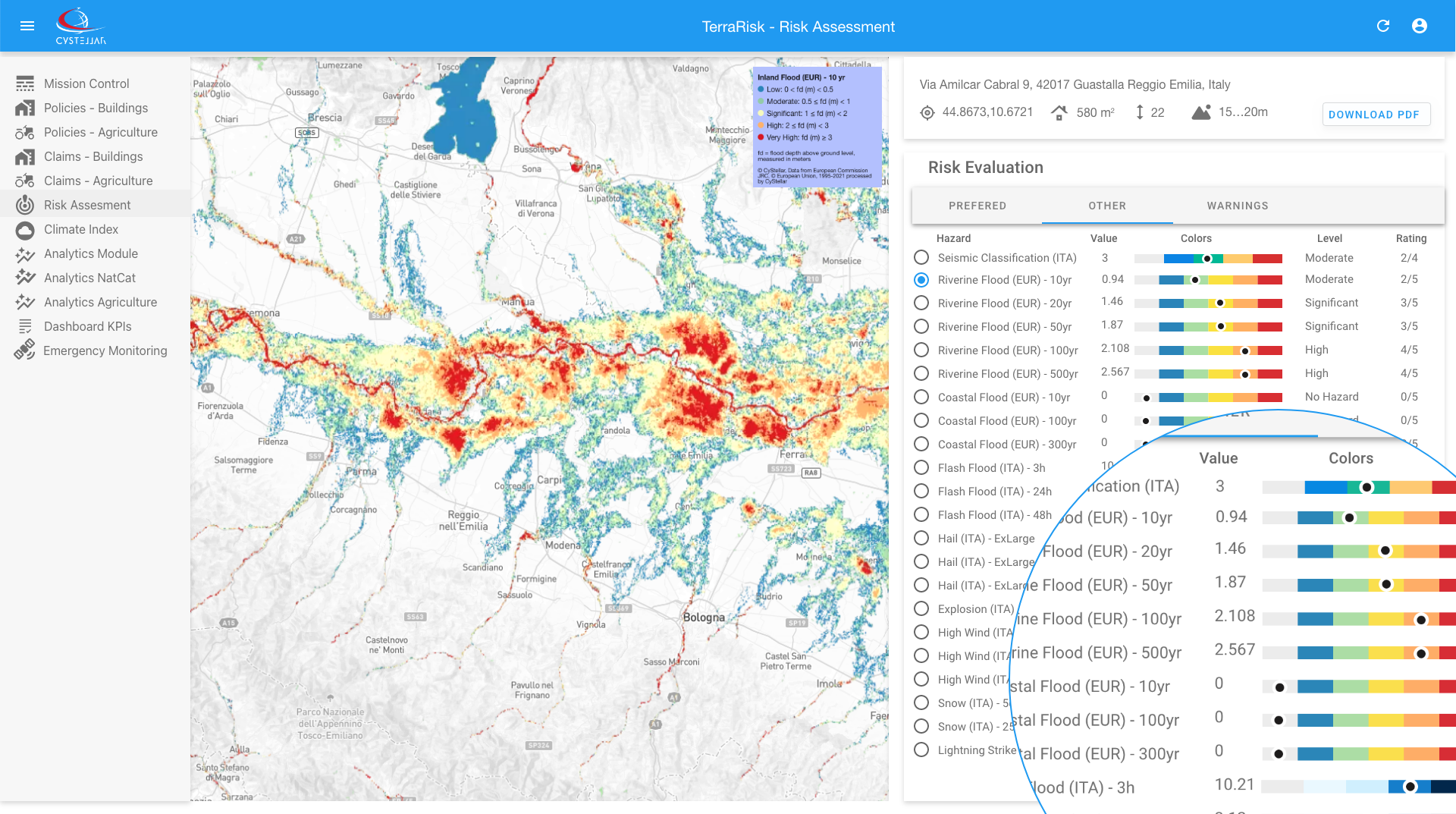

Empower Your Risk Underwriting with Advanced Risk Insights

Elevate your underwriting precision with cutting-edge risk assessment tools tailored for the dynamic world of insurance. Our platform delivers unparalleled insights into natural hazard exposures, enabling you to assess individual sites or entire portfolios with confidence.

Granular Risk Analysis

Dive deep into the specific risks affecting your portfolio, with dedicated insights for multiple natural hazards, including earthquakes, floods, wildfires, and tropical storms.

Leverage hazard datasets that include multiple return periods and climate change scenarios (RCPs). Plan effectively for both current risks and future trends under varying climate conditions.

Interactive Visual Tools

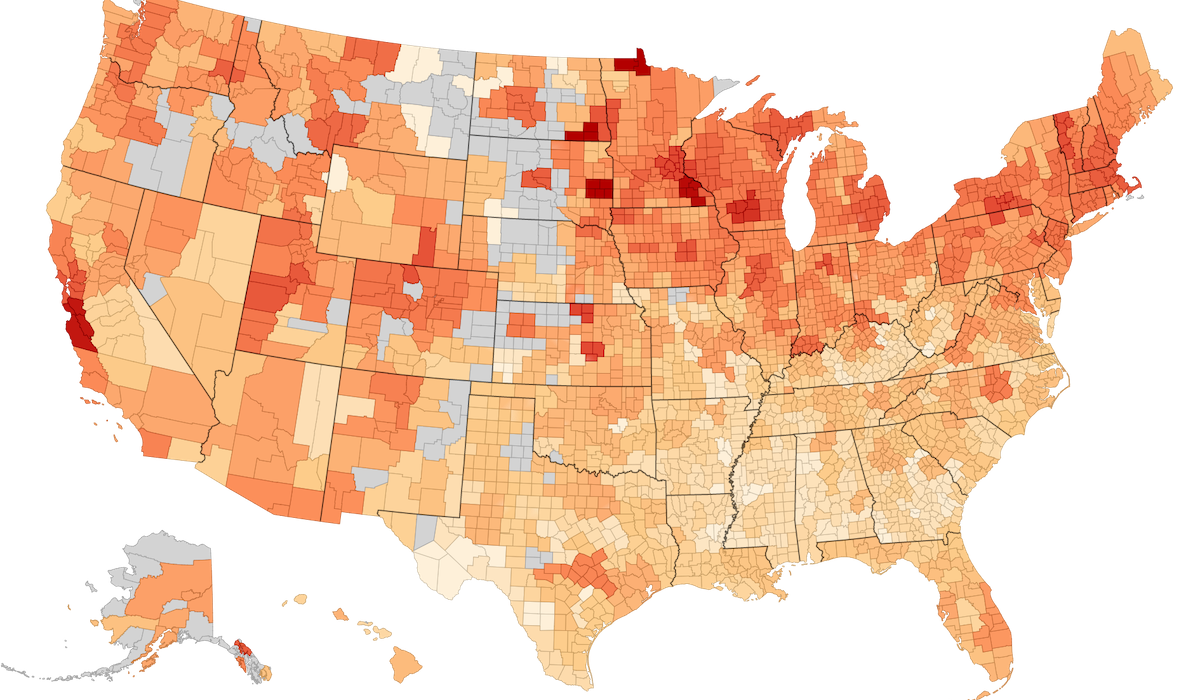

Transform complex data into actionable intelligence with customizable Hazard Maps. Visualize risk hotspots, overlay hazard layers, and generate detailed reports in a few clicks.

National Risk Index maps to asses locations most at risk for multiple combination of natural hazards.

Seamlessly integrate new hazard maps in a plug-and-play manner, offering unmatched flexibility to incorporate regional-specific data.

Smarter Portfolio Management

Optimize risk diversification and identify exposure clusters for improved profitability and informed decision-making..

Leverage advanced data processing to conduct millions of risk assessments each year with high accuracy and comprehensive hazard data diversity

Customizable, scalable, and precise - CyStellar TerraRisk Re platform empowers insurers to continuously expand their risk insights while tailoring underwriting strategies to specific regions. Join the global insurers redefining underwriting with technology designed for flexibility and future-proof decision-making.

Emergency Monitoring

Optimize Capital Allocation with Climate Risk Insights

Our platform empowers partners to assess insurance portfolios and strategically allocate capital while incorporating climate change risks. By leveraging our tools, you can devise effective strategies to minimize environmental impacts and mitigate the risks associated with insured assets.

Comprehensive Environmental Impact Analysis

We specialize in quantifying critical environmental factors, including eutrophication, deforestation, land-use change, methane leakage, land erosion, and land subsidence - key metrics for ESG assessments. These insights enable you to make data-driven decisions that align with sustainability goals and regulatory standards.