Unleash Geospatial Intelligence for Comprehensive Risk Assessment

Mitigate Climate Risks and Boost Resilience with CyStellar's SaaS Platform and API technology.

Powering the Future of Insurance with Satellite-Driven Risk Insights

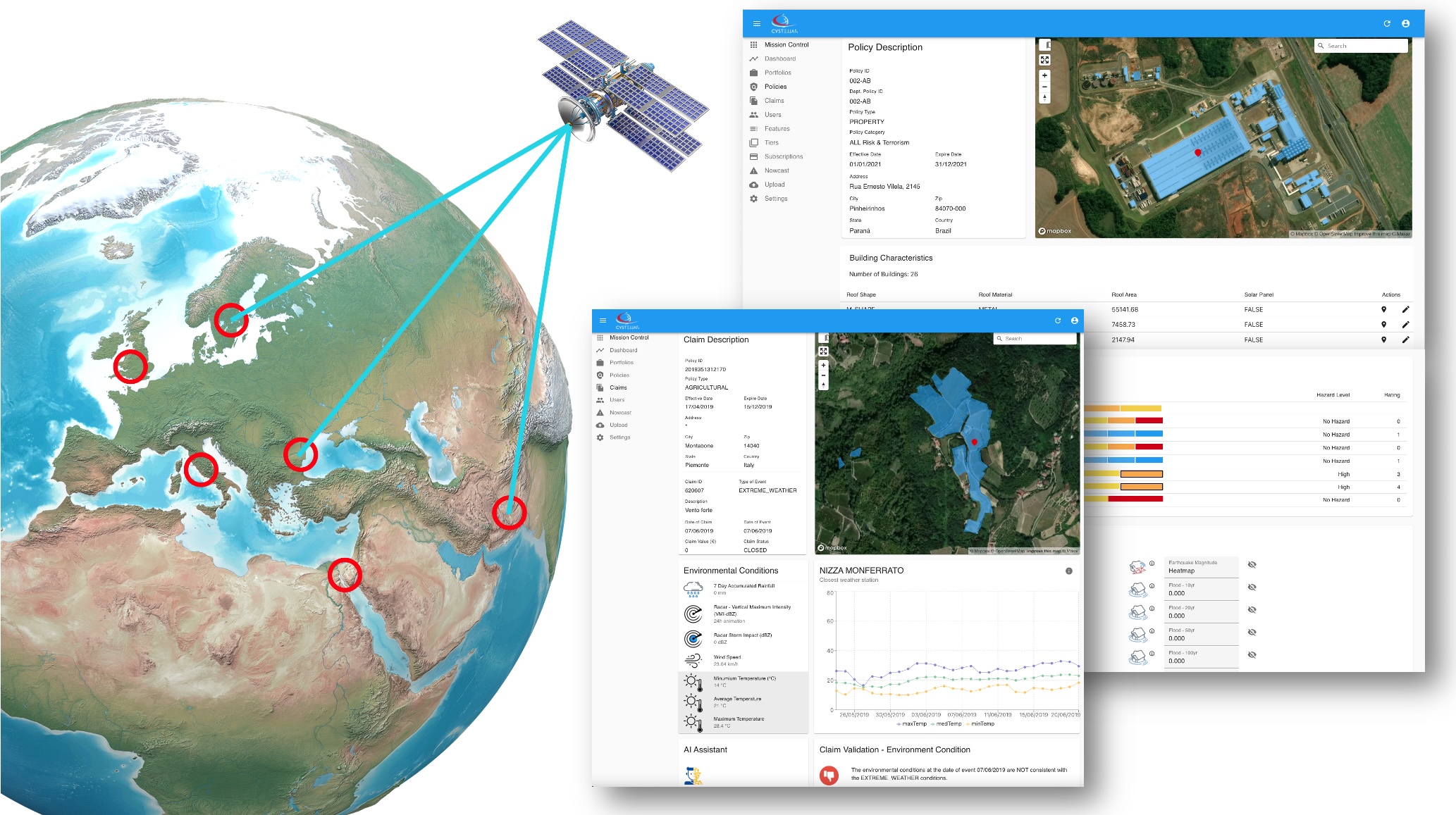

CyStellar's SaaS platform, CyStellar TerraRisk Re, enables insurance providers to harness the power of satellite data and AI to transform their risk assessment and mitigation strategies. Our comprehensive, cloud-based solution integrates a wealth of geospatial data to deliver unparalleled insights, empowering you to make more informed decisions, accelerate claims processing, and build resilience against emerging risks.

Backed by a team of leading experts in Earth observation, artificial intelligence, and insurance, we have created CyStellar TerraRisk Re - a transformative SaaS platform that puts the power of satellite-driven insights at your fingertips. By integrating data from multiple sources, including satellite imagery, weather forecasts, and environmental monitoring, our platform delivers a comprehensive, real-time picture of risk factors, empowering insurers to make more informed decisions, mitigate losses, and build resilience against emerging threats.

CyStellar TerraRisk Re Platform Features

Mitigate Climate Risks and Boost Resilience

with CyStellar TerraRisk Re

Flexible API Integrations for Maximum Connectivity

Our suite of APIs enables seamless integration with third-party applications, allowing you to customize TerraRisk Re’s capabilities to fit your workflows. Access risk insights directly through our APIs and enhance underwriting, claims management, and loss prevention processes with satellite-powered intelligence.

CyStellar Hazards API

CyStellar Claims API

CyStellar NatCat API

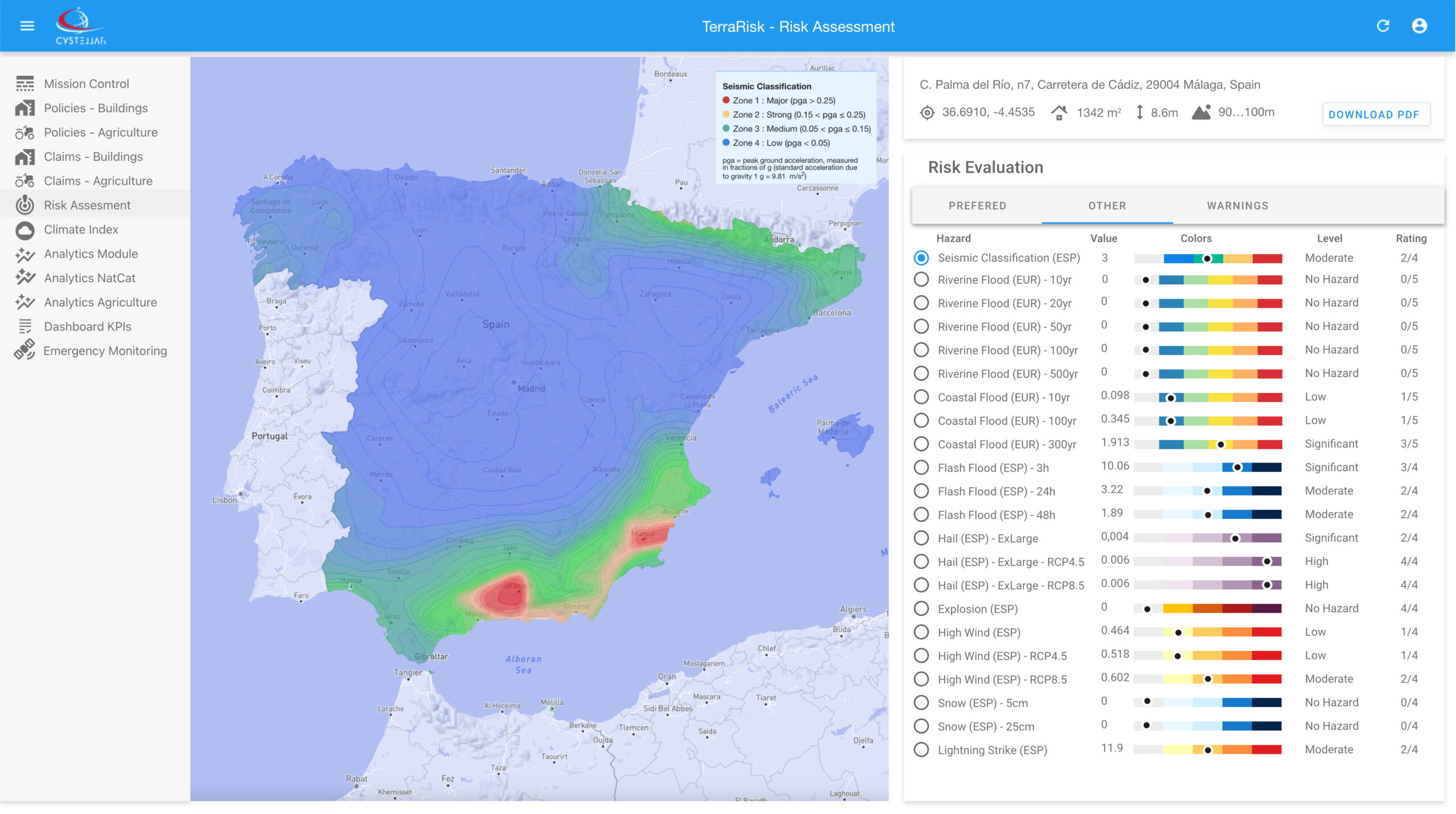

Underwritting

Accurate input into risk selection and underwriting, reserving and ratemaking, exposure and aggregate management, portfolio optimization, pricing and reinsurance.

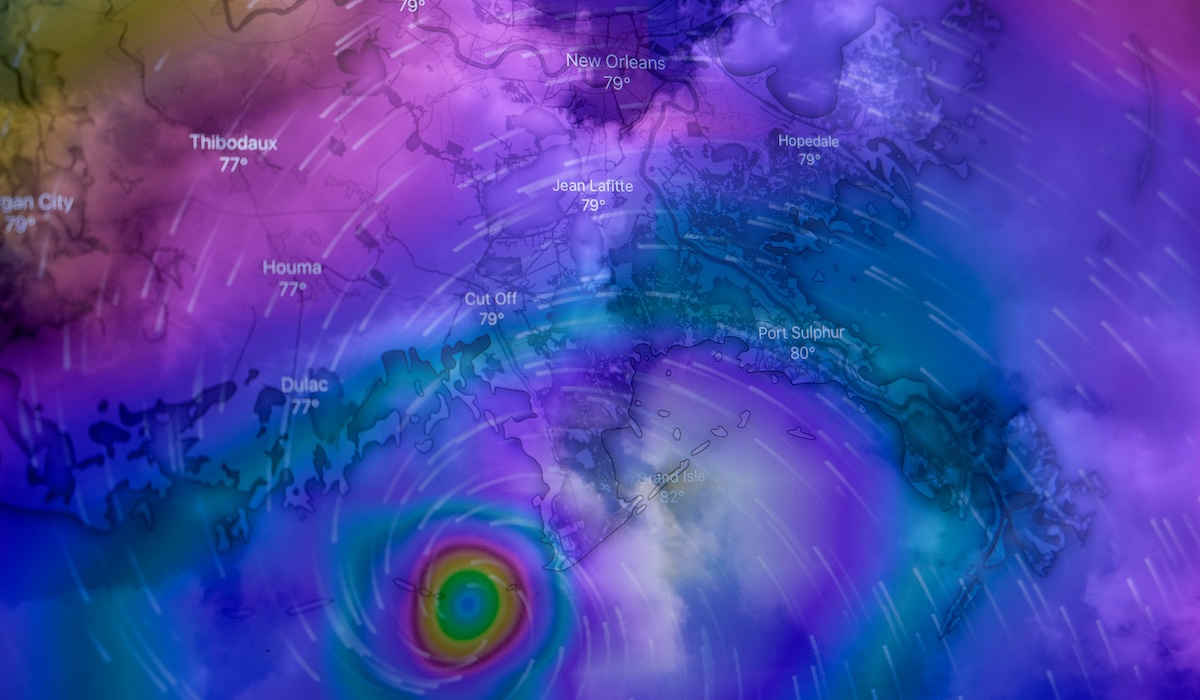

Continuous Risk Monitoring

We continuously detect and classify objects, identify topographic and geographic features, and monitor risks with precision, capturing even the slightest changes over time. This information is seamlessly integrated into (re)insurance workflows, providing remarkable insights into nearly any location worldwide and directly connecting to insurance policies

Claims

Before and after event analysis, automated post-event loss assessment, fraud detection and claim adjustment.

Enhanced Underwriting Accuracy

- Leverage real-time satellite data and AI-powered analytics to make more informed underwriting decisions.

- Access comprehensive risk profiles for any location globally

- Reduce uncertainty with data-driven insights that complement traditional risk assessment methods

- Identify potential risks before they materialize, enabling more accurate pricing strategies

Proactive Risk Management

- Monitor insured assets continuously through satellite observation.

- Receive early warnings about developing environmental and weather-related risks.

- Enable preventive actions through timely alerts and risk notifications

- Support your clients and policy holders with actionable risk mitigation strategies

Operational Efficiency

- Streamline workflows with seamless integration into existing insurance systems.

- Reduce operational costs through automated risk assessment processes.

- Scale your operations efficiently with cloud-based accessibility.

- Access standardized risk reports and analytics across your organization.

Accelerated Claims Processing

- Cut claims processing time by up to 70% with rapid, remote damage assessment capabilities.

- Reduce fraud risks through satellite-based damage assessment.

- Enable faster claims settlements with objective, data-driven loss estimates.

- Minimize the need for on-site inspections with detailed remote sensing analysis.

Competitive Advantage

- Differentiate your insurance products with precise, location-specific risk assessment.

- Expand into new markets with confidence using comprehensive global coverage.

- Optimize your portfolio with deeper insights into risk accumulation.

- Stay ahead of emerging risks with predictive analytics and climate change scenarios.

Regulatory Compliance

- Support ESG reporting requirements with verified environmental impact data.

- Meet increasing regulatory demands for climate risk assessment.

- Maintain detailed audit trails of risk assessment decisions.

- Demonstrate due diligence in risk evaluation processes.